-

We have continued to report on fund flows – investors added 253MM to MUNI funds in the week ended 12/3/25, the previous week saw 217MM inflow, according to the Investment Company Institute. Overall, we see investors seeking yield amid the anticipation that rates will move lower over the next 12 months. The longer end of the curve continues to be bought to lock in higher rates.

-

President Trump said he met this Wednesday with former FED Governor Kevin Warsh as he pushes ahead with his search for the next chair of the central bank. Trump told reporters he was interviewing a “finalist” for the job.

-

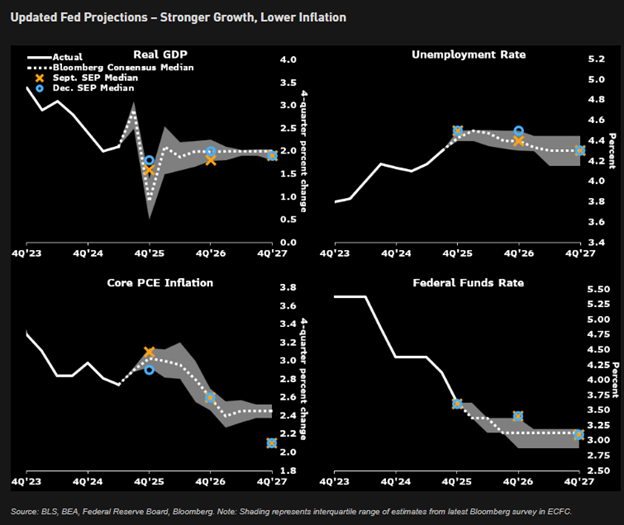

As we know, the FED delivered its third consecutive interest rate reduction and maintained its outlook for just one cut in 2026. The FED voted 12/10 9-3 to lower the benchmark FF rate by .25%. It also suggested greater uncertainty about when it might cut rates again. The decision to lower rates was met with three dissents: two in favor of holding rates steady and one in favor of a larger cut. FED member Goolsbee said inflation fell in November, a surprising comment.

-

On the Dovish side regarding the above, the committee sharply revised up the growth trajectory while lowering the inflation outlook, while keeping the dot plot unchanged. Powell, during his interview, repeatedly noted that the underlying pace of job growth has been negative, even though the dot plot is showing only one cut in 2026; market participants are pricing in two cuts at this time.

-

The FED said it will begin buying 40B of T bills per month starting 12/12, in a move to ease short-term funding costs by rebuilding reserves in the financial system. The FED indicated the reserve balances have declined to ample levels and will initiate purchases of shorter-term T bills as needed on an ongoing basis. We see this moving yields down slightly as they progress through the buying process.

-

White House National Economic Council Director Kevin Hassett indicated he sees plenty of room to lower the FED’s benchmark interest rate substantially. As we have reported, Hassett is the frontrunner in the search for the next chair and indicated he would push for substantially lower rates.

-

MUNIs continue to show resilience, particularly last week while navigating global rate volatility and absorbing a heavy calendar as pre-holiday issuance accelerated. We expect we have two weeks before the seasonal technical takeover, and during this time, we hope to see firm demand through the next couple of weeks.

Bottom Line

The Dot plot in our opinion will change as we move into the 1st Qtr. of 2026 due to the nomination of the new FED Chair. Although it currently shows one cut (which could happen), we think markets will change their outlook once the new FED chair is in the seat. Rates seem to be stubborn here, with the 10T holding around the 4.10-4.15% rate. Labor markets remain weak, and this is likely to continue for the next couple of months.

Securities offered through NewEdge Securities, LLC, member FINRA and SIPC. The DRL Group is not a subsidiary or control affiliate of NewEdge Securities, LLC. NewEdge Securities, LLC. has no affiliation to BondDesk Trading LLC or BondTrader Pro, or Tradeweb Direct, Bondpoint, TMC, Market Axess or any ECN.

Yield to call (YTC) is not indicative of total return; this yield is valid only if the security is called. Bonds may or may not be called, or be callable on multiple dates or, in other cases, called any date following the first call date, so yield to call is based on the earliest stated call date. Discounted bonds may be subject to capital gains tax. Bonds may be subject to OID (Original Issue Discount). Prices and availability may change at anytime without notice.

Do not buy bonds based on the Yield to Call (YTC). Insured bonds are issued for timely payment of principal and interest only. Insured bonds do not cover potential market loss and are subject to the claims paying ability of the insurance company.

Non-rated (NR), With-Drawn (WR), or below investment grade bonds, lower rated bonds, carry a greater potential risk of default & should be considered by sophisticated investors only.

This document is for informational purposes only and does not replace or serve as a substitute for your official monthly statement generated by NFS. Please refer to your official statement for accurate and comprehensive account details.

Bonds may be subject to capital gains tax. This summary is for informational purposes only and is not an offer or solicitation for the purchase or sale of any security or a recommendation or endorsement of any security or issuer. NewEdge Securities, LLC. and DRL Group make no representation about the accuracy, completeness, or timeliness of this information. Bonds could also be subject to the DeMinimis Rule, please consult with your tax advisor for further clarification.

Call us at 281-398-8600 to invest in these or any of our other offerings today.