- We saw another +20-bps day on 4/9 based on evaluations as MUNIs continued the selloff. The rout drove the 10-year AAA benchmark to 3.80%, which is the highest since at least 2011, according to Bloomberg evaluations. Over the last three trading sessions, rates have jumbled about 87bps, and Investors are searching for liquidity.

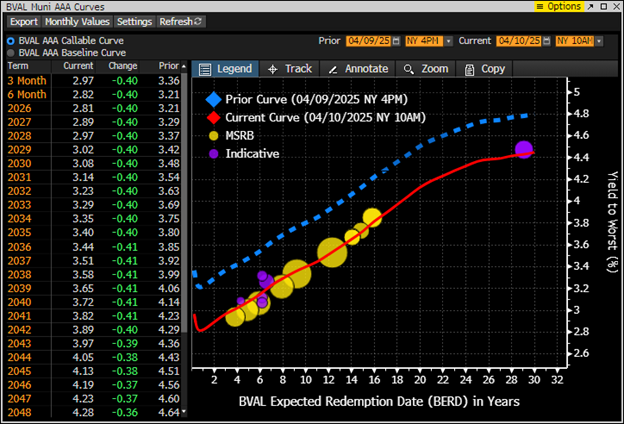

- 4/10 we are starting to see a reversal in yields with the entire curve shifting lower – still too early to tell in the day to make a read as of this writing. We have attached a graph from Bloomberg showing the shift lower across the curve.

- The FED indicated that it is continuing to hold its policy rate steady to minimize the risk that Trump’s tariffs will trigger a persistent rise in inflation, even if the labor market softens further. Many officials indicated they are sending a clear signal that they are ruling out interest rate cuts that would act as a “backstop” as an insurance policy against any tariff-induced economic slowdown.

- Goldman rescinded its forecast for a US recession yesterday (4/9) after Trump announced a 90-day pause on most of his previously announced tariffs. It indicated that it was reverting to its previous non-recession baseline forecast.

- The CPI numbers were released today, 4/10, and they were soft. Overall, the CPI declined by .10% from a month earlier, the first decrease in nearly five years. A decline in energy costs used cars, and airfares helped the CPI. At this time, just like the job’s numbers last week, these numbers are not getting a lot of attention, due to what is going on in the Global Markets.

- As we saw, financial markets cheered Trump’s decision to delay some of his tariff plans, the first signs of a slowdown in global trade. This slowdown is emerging as companies worldwide hit their own pause button on orders as the administration continues to escalate its trade war with China.

- I suspect we will continue to have “extreme readings” from the market, followed by weak pricing in all markets. Keep in mind your taxable equivalents and your long-term goals. If you are seeking to build your tax-exempt income, yields are very attractive here. Credit Quality is virtually unchanged and expected to stay stable.

- As we saw last week, yields plunged based on tariff concerns. Now, as indicated above, we are seeing yields rapidly rise due to those same tariff concerns, and now they are moving back down…. rollercoaster few days. The job numbers posted last Friday had almost zero impact on the markets. The primary focus again is Trump and how the tariffs will impact the economy.

- Deals are getting shelved at this time due to the rapid rise in yields. We saw heavy issuance leading into last week, but this has now reversed itself due to the rapid rise in yields. This should impact supply (reduction) in the coming weeks.

- For the better part of Tuesday, 4/8, it seemed as if the panic created by Trump’s trade war had subsided. However, as the day wore on, optimism reversed and gave way to down markets across the board. To put this into perspective, equities have lost ~10 trillion in value over the last three days, again rollercoaster.

- Federal Reserve Bank of San Francisco Mary Daly indicated that the US central bank could “take its time” on rate moves, as she and others would like to see how trade policy plays out. With the 100bps cut last year, she indicated that she kept the policy in a good place to stay modestly restrictive for the near term. It will be interesting to read how the FED will gauge and comment on the market swings over the last few days should they decide to do so.

- According to JP Morgan’s dashboard of market-based recession indicators, the small cap-focused Russell 2000, beaten up with the sell-off, is now pricing in a 79% chance of an economic downturn. Other asset classes are also sounding alarms, with 5-year T bills indicating a 54% chance. Should we start to see recession fears escalate, one would think you would see a “flight to safety” into asset classes such as higher-grade fixed income.

At The DRL Group, we specialize in helping high-net-worth investors maximize tax-free returns by proactively maintaining their custom bond portfolios through all market conditions.

David Loesch

[email protected]

www.drlgroup.net

605-B Park Grove

Katy, TX 77450

866.664.4040 (toll-free)

281.398.8600 (direct)

Securities offered through NewEdge Securities, LLC, member FINRA and SIPC. The DRL Group is not a subsidiary or control affiliate of NewEdge Securities, LLC. NewEdge Securities, LLC. has no affiliation to BondDesk Trading LLC or BondTrader Pro, or Tradeweb Direct, Bondpoint, TMC, Market Axess or any ECN.

Yield to call (YTC) is not indicative of total return; this yield is valid only if the security is called. Bonds may or may not be called, or be callable on multiple dates or, in other cases, called any date following the first call date, so yield to call is based on the earliest stated call date. Discounted bonds may be subject to capital gains tax. Bonds may be subject to OID (Original Issue Discount). Prices and availability may change at anytime without notice.

Do not buy bonds based on the Yield to Call (YTC). Insured bonds are issued for timely payment of principal and interest only. Insured bonds do not cover potential market loss and are subject to the claims paying ability of the insurance company.

Non-rated (NR), With-Drawn (WR), or below investment grade bonds, lower rated bonds, carry a greater potential risk of default & should be considered by sophisticated investors only.

This document is for informational purposes only and does not replace or serve as a substitute for your official monthly statement generated by NFS. Please refer to your official statement for accurate and comprehensive account details.

Bonds may be subject to capital gains tax. This summary is for informational purposes only and is not an offer or solicitation for the purchase or sale of any security or a recommendation or endorsement of any security or issuer. NewEdge Securities, LLC. and DRL Group make no representation about the accuracy, completeness, or timeliness of this information. Bonds could also be subject to the DeMinimis Rule, please consult with your tax advisor for further clarification.

Call us at 281-398-8600 to invest in these or any of our other offerings today.