- We have a video on our website about the MUNI exemption, Are Tax Exemptions Going Away. It is appropriate, based on the news, that a group of Republicans are standing up for the MUNI tax exemption, indicating that the tax exemption must stay. In a letter 7 Republicans sent to the Ways and Means Committee, it stated the MUNI exemption is a “critical tool” that has underpinned American infrastructure and community development for over a century. As discussed, this issue often comes up when we change administrations and many others, and I suspect this will not be a topic for finding additional ways to raise revenue for the government.

- Regarding the above point, French Hill (US Representative and chairman of the House Financial Services Committee) indicated that “preserving access to tax-exempt financing is especially critical for smaller and rural issuers, who often lack alternative pathways to affordable capital.”

- From an issuance standpoint, taxable MUNIs remain in a lull. Much (like other issuance) of this can be blamed on interest rates spiking. With this lull of issuance, we have seen taxable MUNIs perform slightly better than traditional MUNIs thus far.

- Bank executives’ commentary over the past week made it clear they are worried about where the economy is headed, but their 1st Q results were relatively strong. However, executives also expressed caution, citing uncertainty and unpredictability in the macro environment. Some banks have increased their loan-loss reserves in preparation for potential downturns. With the increased volatility of all markets, it seems like traders are agreeing with a pending downturn.

- US Industrial Production released 4/16 fell .3% MOM with an estimate of -.2%. As of this writing, it has not had much impact on T bills, and most likely will not be due to the tariff talk with China. As mentioned last week, the tariff headlines are taking “center stage” and should continue to dominate headlines until the China issue is addressed.

- Treasury assets are traditionally seen as a safe haven, but last week, they lost some of this status as investors dumped them along with stocks and other risky assets, causing, as we know, yields to surge. The loss of confidence in US bonds has a profound impact on the global financial system, and they are used as a “benchmark” to determine the price of other assets. Many think last week’s swings were overdone; time will tell. We are seeing yields come down slightly across the curve on HG MUNI assets.

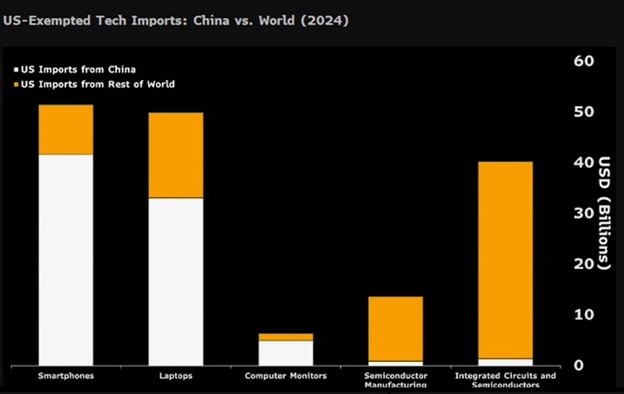

- As we know, Trump’s tariff strategy has shifted again. Exemptions for Key Technology imports were announced on 4/11, highlighting how entrenched supply chains and domestic economic concerns can constrain the administration’s agenda. I have attached a bar graph showing these imports, and just how much comes from China.

- MUNIs have become attractive for bargain-hunting investors after a historic rout pushed up yields last week. We have not seen yields like this in years. However, a better way to put this is that we have not seen “moves” like this in years either. For example on where yields are, for an investor in CA to get the same value in a similar T bond, the T bond would have to yield 8.11% to match the MUNI in CA, and as we know, T bonds are nowhere near that.

Securities offered through NewEdge Securities, LLC, member FINRA and SIPC. The DRL Group is not a subsidiary or control affiliate of NewEdge Securities, LLC. NewEdge Securities, LLC. has no affiliation to BondDesk Trading LLC or BondTrader Pro, or Tradeweb Direct, Bondpoint, TMC, Market Axess or any ECN.

Yield to call (YTC) is not indicative of total return; this yield is valid only if the security is called. Bonds may or may not be called, or be callable on multiple dates or, in other cases, called any date following the first call date, so yield to call is based on the earliest stated call date. Discounted bonds may be subject to capital gains tax. Bonds may be subject to OID (Original Issue Discount). Prices and availability may change at anytime without notice.

Do not buy bonds based on the Yield to Call (YTC). Insured bonds are issued for timely payment of principal and interest only. Insured bonds do not cover potential market loss and are subject to the claims paying ability of the insurance company.

Non-rated (NR), With-Drawn (WR), or below investment grade bonds, lower rated bonds, carry a greater potential risk of default & should be considered by sophisticated investors only.

This document is for informational purposes only and does not replace or serve as a substitute for your official monthly statement generated by NFS. Please refer to your official statement for accurate and comprehensive account details.

Bonds may be subject to capital gains tax. This summary is for informational purposes only and is not an offer or solicitation for the purchase or sale of any security or a recommendation or endorsement of any security or issuer. NewEdge Securities, LLC. and DRL Group make no representation about the accuracy, completeness, or timeliness of this information. Bonds could also be subject to the DeMinimis Rule, please consult with your tax advisor for further clarification.

Call us at 281-398-8600 to invest in these or any of our other offerings today.